Successful implementation

.

Within the preparation for Solvency II, the implementation of the Own Risk and Solvency Assessment (ORSA) enters into the second phase. The undertakings have to demonstrate for the first time that they will comply with the regulatory capital requirements during the whole planning period. Due to the planning perspective, the demonstration of the compliance is linked with the corporate governance. Therefore a successful implementation has to consider an adjustment of the governance system and should thus start in time.

Challenges

Risk strategy: Generally the compliance with the regulatory capital requirements will be demonstrated by scenario calculations over the undertakings planning period. Due to the planning, respective multi-periodic perspective, risk events and governance actions will interact thereby. The interaction, in turn, is determined by the undertakings risk strategy. Thus, the risk strategy has to be adapted to the ORSA-requirements.

Planning and controlling processes: Principally, an effective ORSA implies that business planning and scenario calculation will be performed iteratively. Furthermore, in order to ensure that the outlined governance actions will take place in case of risk events, the undertakings have to implement respective triggers within their controlling processes. Thus, the planning and controlling processes have also to be adapted to the ORSA.

Missing confidence level: Within pillar one of Solvency II, the confidence level of the Solvency Capital Requirement (SCR) quantifies the undertakings risk appetite in a one-year time horizon. In case of a multi-periodic perspective however, the probabilities of scenarios are hardly to determine and thus a confidence level is difficult to apply.

Manifold of scenarios: Principally, the combination of risk events with governance actions in a multi-periodic perspective creates a manifold of scenarios. In order to keep the planning and controlling processes still efficient, the considered scenarios have generally to be limited. Furthermore, the iterations between planning and scenario calculation have also to be limited.

Approach

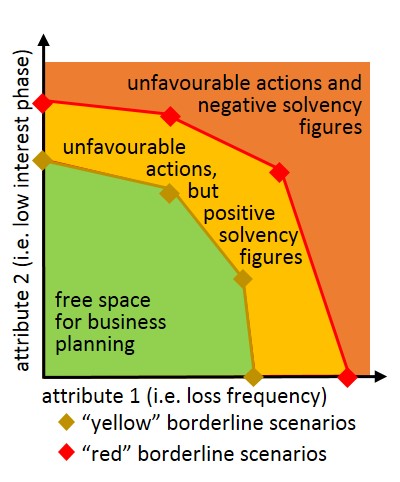

Borderline scenarios: An alternative way to define the risk appetite in a multi-periodic perspective, is to consider representative borderline scenarios. Thereby a borderline scenario describes the point, from which on the undertaking has to apply unfavourable measures from the shareholders point of view (i.e. lowering return, raising own funds) and where the solvency figures might have negative outcomes from the supervisors point of view (see figure 1).

Generally, the selected scenarios must be clear and comprehensible for all recipients. Also, the corresponding measures must be binding for the management board and the associated consequences must be quantified in amount and duration for the shareholders and the supervisors.

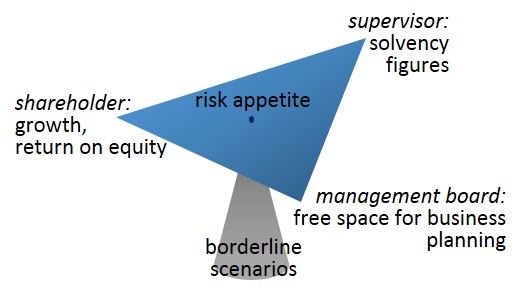

Simulation system: An advantageous risk strategy is characterized by the largest possible planning space for the management board as well as acceptable consequences for the shareholders and supervisors. Thereby the risk appetite figures a balance between the different interests (see figure 2).

In order to find such a strategy, the entire space of scenarios and measures has to be illuminated. This requires a simulation system for automatic scenario calculation. The system is not comparable with an internal model because the simulation system reflects only the most important relationships and calculates on basis of simplified rules.

Workflow-management system: Even if the planning could performed largely independently of the scenario calculations, plan revisions and thus recalculations of the scenarios could not be excluded. Also, within the controlling process, the scenarios have to be calculated again if the business develops in another direction or the environment changes (Ad hoc ORSA). In order to obtain efficient and audit-proof processes, a workflow-management system is additionally necessary. This system can also be used for other Solvency II purposes – i.a. for the quantitative reporting.

All in all, the meanwhile available simulation and workflow-management systems are largely mature and partly not expensive.

Implementation

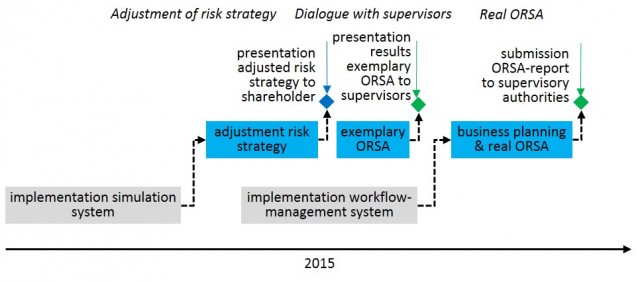

Basically, the management board should seek for a confirmation of the adjusted risk strategy by the shareholders and the supervisors in order to ensure a sufficient space for the upcoming business planning. Therefore the second phase of the ORSA implementation could be separated into three parts (see figure 3):

Adjustment of the risk strategy: At first, the management board should seek for a confirmation of the risk strategy by the shareholders.

Dialogue with the supervisors: Afterwards, the ORSA could be executed exemplarily on the basis of the past planning and the results could be communicated to the supervisors on a high level.

Application of the real ORSA: Finally, the real ORSA could be performed within the upcoming business planning and the respective ORSA-report could be submitted to the supervisors.